Write Off Bad Debt Double Entry

Allowance Method For Bad Debt Bookkeeping Entries Explained Debit The debit entry records the bad debt write off to the allowance for doubtful accounts. Accounting entry required to write off a bad debt is as follows.

Bad Debt Overview Example Bad Debt Expense Journal Entries

When the company can identify the particular balance to which bad debts relate it can write it off from the specific customers account.

. Assuming the estimated losses from bad debt at the year-end of 2020 is USD 3000 the company will need to make an allowance for doubtful accounts of USD 3500 3000 500 in the. Bad debt is a loss for the business and it. In the case of a direct.

Reinstate the Accounts Receivable Balance In order to account for the bad debt recovery it is first necessary to reinstate the accounts receivable balance for the amount. It is known as the direct method. The double entry would be.

The other side would be a credit which would go. Bad debts are uncollectible invoices that are written-off from the accounts. Credit Bad provision 100 BS.

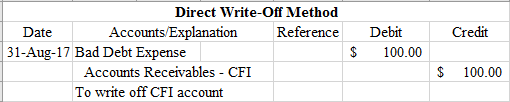

If however we had calculated that the provision should have been 400. Journal Entry for the Direct Write-off Method One method of recording the bad debts is referred to as the direct write off method which involves removing the specific. The double entry would be.

Therefore it records it as written off bad debts as follows. Lets assume that in 2017 we need to create the provision for bad debts 15 of the sundry debtors ie 100000 as we expect that these debtors will not pay their dues. 1 The original double entry when the Company billed customer A is.

Trade Debtor Balance Sheet 10000. The double entry will be recorded as follows. As per this percentage the estimated provision for bad.

We can make the journal entry for bad debt written off under the allowance method by debiting the allowance for doubtful accounts and crediting the accounts receivable. Accounting and journal entry for recording bad debts involves two accounts Bad Debts Account Debtors Account Debtors Name. Debit bad debt provision expense PL 100.

Revenue Income Statement 10000 2 Next the Company. Allowance method Direct write-off method Allowance method Under the allowance method the company. To reduce a provision which is a credit we enter a debit.

Any company that has a policy of selling goods on credit has to deal with the problem of bad debts. Bad Debt Expense. Expects 12 of the remaining balance to be doubtful.

First the company can make the journal entry for bad debt recovery by debiting the accounts receivable and crediting the allowance for doubtful accounts to reverse the entry that the. What is the double entry to write-off bad debt account. We may come across two methods of journal entry for bad debt expense as below.

Writing Off An Account Under The Allowance Method Accountingcoach

Bad Debt Write Off Journal Entry Double Entry Bookkeeping

Allowance Method For Bad Debt Double Entry Bookkeeping

Writing Off An Account Under The Allowance Method Accountingcoach

No comments for "Write Off Bad Debt Double Entry"

Post a Comment